Shiny Pursuits: The Joy of Collecting Gold & Silver – A Passionate and Rewarding Hobby

Collecting gold and silver is more than just a hobby; it’s a passion that brings joy and satisfaction. Owning a piece of precious metal offers a sense of historical connection and financial security. Each coin or bar tells a story and adds to your unique collection, making it a rewarding experience.

The allure of gold and silver is timeless. Many collectors find excitement in acquiring rare and valuable pieces. It’s not just about the monetary value; the thrill comes from finding a unique item that enhances your collection and brings enjoyment.

Starting your collection can be simple. With resources like Mintbuilder, you can easily step into the world of gold and silver. You can build your collection at your own pace, ensuring each piece meets your standards for authenticity and value.

Key Takeaways

- Collecting brings both joy and historical connection.

- The allure lies in finding rare and valuable pieces.

- Start your collection with trusted resources like Mintbuilder.

The Allure of Gold & Silver

Gold and silver have captured human interest for centuries. These metals are not only valuable but also hold significant historical, economic, and cultural importance.

Historical Significance

Gold and silver have been treasures since ancient times. Ancient Egyptians used gold for jewelry and tombs, believing it had divine properties. Silver, too, played a role in early civilizations, often used in trade and coins.

During the Middle Ages, gold and silver were symbols of royal power. Kings displayed wealth through gold crowns and silver ornaments. These metals were also crucial during the Age of Exploration. Explorers sought gold and silver, leading to the colonization of the Americas.

Economic Influence

Gold and silver are vital in the modern economy. Central banks hold vast amounts of gold as a reserve asset, providing financial stability. These metals act as a hedge against inflation. When currency values drop, the value of gold and silver usually rises.

Investors purchase gold and silver as safe assets during economic uncertainty. They are also integral to industries like electronics and medicine. Silver, for instance, is used in solar panels and medical devices due to its conductivity and antibacterial properties.

Cultural Impact

Gold and silver play significant roles in culture and tradition. In many cultures, gold is given as a gift during weddings and festivals, symbolizing prosperity and good fortune. Silver also holds symbolic meanings; in Western cultures, silver anniversaries mark 25 years of marriage.

Both metals appear in folklore and literature. Stories of buried treasure often involve gold and silver coins. They are also present in religious artifacts. Many religious institutions decorate icons with gold and silver, emphasizing purity and divinity.

Starting Your Collection

Starting a gold and silver collection can be exciting and rewarding. Focus on picking a niche, setting a budget, and knowing the market value of your items.

Choosing Your Niche

Selecting a niche helps you narrow down what types of gold and silver items you want to collect. You might choose coins, bars, antique jewelry, or even bullion. Consider what interests you the most. Research various options to understand what appeals the most to you.

Gold coins often come from different countries and periods. You may find joy in collecting coins from your own country or from ancient civilizations. Each type has unique characteristics that can make your collection special.

Budgeting for Beginners

Setting a budget is essential when starting your collection. Decide how much you are willing to spend monthly or yearly. A clear budget prevents overspending and helps you make thoughtful choices.

You may find that starting small is best. Look for pieces that fit within your financial plan. Over time, as you become more knowledgeable, you might decide to invest more money into your collection.

Understanding Market Value

Knowing the market value of gold and silver items is crucial. Prices can fluctuate based on demand, rarity, and condition. Familiarize yourself with market trends to make informed purchases.

Learn where to find trustworthy information about market values. Websites, books, and experts can provide up-to-date details. Pay attention to factors like weight, purity, and historical significance. This knowledge will help you make wise buying decisions and grow a valuable collection.

Collection Management

Properly managing your collection is crucial for keeping your gold and silver items in top condition and preserving their value. This includes organizing, storing, and insuring your collectibles to ensure they remain in pristine shape for years to come.

Cataloging Your Items

Cataloging helps you keep track of every item in your collection. Start by creating a list with details such as the item’s type, weight, purity, and purchase date. Use a spreadsheet or specialized software for easy updates.

Example catalog entry:

| Item | Weight | Purity | Purchase Date |

|---|---|---|---|

| Gold Coin | 1 oz | 99.9% | 01/01/2023 |

Taking photos of each item can also be helpful. This visual record can assist in identifying and verifying your items. Keeping digital copies in a secure location, such as cloud storage, adds an extra layer of security.

Storage & Preservation

Storing your items correctly ensures they maintain their condition. Use soft cloth bags or coin capsules to protect individual items from scratches. For larger collections, a safe or bank deposit box provides additional security.

Tips for storing:

- Avoid humid areas to prevent tarnishing.

- Keep items in a cool, dry place.

- Use silica gel packets to control moisture.

Proper storage practices help in preserving the physical and aesthetic aspects of your collection, which is essential for maintaining value.

Insurance for Collectibles

Insuring your collection protects you against loss, theft, or damage. Start by getting an appraisal to determine the value of your collection. Then, look for an insurance policy specifically for collectibles.

Key points:

- Choose a policy that covers full replacement cost.

- Check for coverage details like protection during transit.

- Ensure the appraiser is certified for accurate valuation.

Documenting your items through cataloging and photography makes the insurance process smoother. Having insurance gives peace of mind, knowing that your investment is safeguarded against unforeseen events.

Acquisition Strategies

When collecting gold and silver, having effective strategies is key. You should know how to negotiate, participate in auctions, and choose the best online marketplace.

Negotiation Techniques

Negotiating is a crucial skill. Always research the item’s market value before starting. This helps you set a fair price. Be polite and stay patient. Sellers might be more willing to lower their price if you show you know what you are talking about.

Also, mentioning past sales or market trends can bolster your argument. Sometimes agreeing on a bundle deal can get you a better price. Always stay firm but flexible, adapting to the seller’s responses.

Auctions and Bidding

Auctions are a thrilling way to acquire gold and silver. Set a budget and stick to it. Emotion can lead to overspending. Pre-bid research on the items helps you gauge true value. Visit auction websites or attend live events to understand bidding patterns.

Bid strategically. Start with modest bids and observe other bidders. When the right moment comes, increase your bid decisively but within your budget limit. Knowing when to walk away is critical.

Why Mintbuilder is the Best Online Marketplace

Mintbuilder offers a reliable platform for buying gold and silver. It provides detailed descriptions and high-quality images, helping you make informed choices. Their reputation for authenticity is strong, which is vital in reducing risks of buying counterfeit items.

The site is easy to navigate, and customer service is responsive. Reviews from other users give insights into their buying experiences. Competitive pricing and frequent sales also make Mintbuilder a cost-effective option for both new and seasoned collectors.

Authenticity & Appraisal

When collecting gold and silver, it’s crucial to verify authenticity and understand the appraisal process. This helps safeguard your investments and ensures you know the value of your collection.

Identifying Forgeries

Spotting fake gold and silver items can save you from costly mistakes. Check for marks like hallmarks or stamps indicating purity or origin. Use a magnet; real gold and silver are not magnetic. Weigh your item; fake pieces often differ in weight. Look at the design and craftsmanship; poor quality can signal a forgery.

Body acid tests can also help. Use a testing kit with acid and a scratch stone. If unsure, seek a professional’s opinion.

List of Common Hallmarks:

- Gold: 24K, 18K, 14K

- Silver: 925, Sterling

Finding Trusted Appraisers

Finding a knowledgeable appraiser is vital. Look for certifications from respected organizations like the American Society of Appraisers or Gemological Institute of America. Experienced appraisers can give accurate valuations and spot fakes.

Read reviews and ask for recommendations from other collectors. Check if the appraiser specializes in the type of items you collect. Always get a written appraisal for records.

Finding an appraiser you trust builds confidence in your collection’s value.

Key Steps to Find an Appraiser:

- Check Certifications

- Read Reviews

- Ask for Recommendations

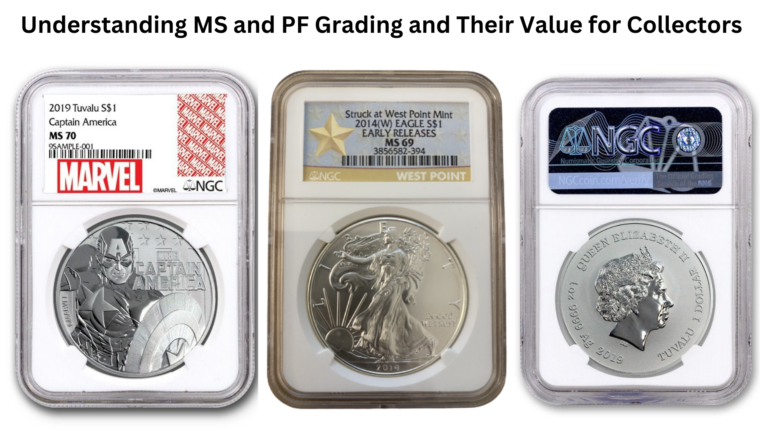

Grading Systems

Grading systems categorize the quality and value of gold and silver items. Gold is often graded on its karat purity: 24K being pure gold. Silver is graded mainly using its purity levels, like .999 for fine silver.

Coins have different grading scales, such as MS (Mint State), to indicate condition. Knowing these scales helps you understand the market value better.

Certified grading from professional services can increase the value of your items. Always stay informed about grading standards to make wise investments.

Example of Gold Karat System:

- 24K: Pure Gold

- 18K: 75% Gold

- 14K: 58.5% Gold

Networking with Collectors

Connecting with others who share your interest can make collecting gold and silver even more enjoyable. You can join communities, attend trade shows, and engage in online forums to expand your network.

Joining Collector Communities

Finding local or national collector clubs can be incredibly beneficial. These groups often meet in person and offer you a chance to exchange tips and discuss market trends.

You can join organizations like the American Numismatic Association. Many clubs also organize events where you can showcase your collection or see items from fellow enthusiasts. Membership usually comes with newsletters, magazines, or online content that keeps you updated.

By participating in these communities, you can build strong connections and learn from more experienced collectors.

Attending Trade Shows

Trade shows are excellent for meeting a wide range of collectors and dealers. Events like the World’s Fair of Money and regional coin shows let you see rare items up close.

At these shows, you can attend workshops and seminars that provide deeper insights into the hobby. These events often have appraisers who can help you understand the value of your collection.

You will also find many opportunities to network and even barter for items that interest you. A face-to-face meeting with experts and like-minded collectors can significantly enrich your experience.

Social Media and Online Forums

The internet offers many platforms where collectors gather virtually. Websites like Reddit and specialized forums such as CoinTalk or Collectors Universe are great places to start.

Social media groups on Facebook, Instagram, and Twitter also host communities centered around gold and silver collecting. You can post pictures, ask questions, and share stories to engage with others.

Being active in these online spaces helps you stay up to date on trends, news, and events related to your hobby. You can also find deals and trades that wouldn’t be available locally.

Online forums and social media give you a more relaxed environment to network and learn.

The Philosophy of Collecting

Collecting gold and silver offers more than just a financial boost. It brings joy, mental rewards, and the chance to create a lasting heritage.

Psychological Benefits

Collecting can greatly enhance your mental well-being. Finding a rare coin or piece of jewelry brings a rush of happiness and satisfaction. Each item in your collection can remind you of personal achievements and milestones.

Organizing and researching your collection also improves cognitive skills. It encourages focus and attention to detail. The social aspect should not be overlooked either, as engaging with other collectors builds community and shared knowledge.

Investment vs. Hobby

Balancing enjoyment and profit can be tricky in gold and silver collecting. As an investment, these metals can store value over time, hedging against inflation.

You can watch market trends and make informed decisions when buying or selling items. That said, focusing purely on investment may take the fun out of collecting. It’s important to keep enjoyment as a key aspect while also recognizing the financial potential.

Passing on Your Legacy

Building a collection is a way to create a legacy. Gold and silver items are often durable and can be passed down through generations. Sharing stories about each piece gives them sentimental value and keeps your memory alive.

Your collection can also serve as a financial safety net for your descendants. Teaching younger family members about its history and value ensures they appreciate and care for it. This way, your passion can live on, enriching future generations.

Diversifying Your Collection

Diversifying your collection can add excitement and value. Focus on international pieces, rare finds, and understanding modern versus historical items.

Exploring International Pieces

Collecting gold and silver from different countries can be rewarding. Each nation has unique designs and historical contexts. For instance, gold coins from China often feature pandas, while American coins might showcase eagles. It’s important to learn about different mint marks, which tell you where a coin was produced.

You can also discover new cultures and histories. Coins and jewelry from different regions have distinct artistic styles. This diversity enriches your collection and makes it a conversation piece. Don’t forget to verify authenticity and provenance to ensure you’re getting genuine items.

Rare and Unique Finds

Rare items can be the crown jewels of your collection. These might be limited-edition coins, discontinued designs, or pieces with historical significance. For example, the 1933 Double Eagle coin is extremely rare and valuable. Owning such items can increase your collection’s value and prestige.

It’s essential to stay informed about market trends. Auctions and collector magazines often highlight rare finds. Be prepared to act quickly, as rare pieces are highly sought after. Building relationships with reputable dealers can also help you access exclusive items.

Modern vs. Historical Items

Modern and historical items each offer unique perks. Modern pieces, like newly minted coins, can be easier to find and often come in pristine condition. They’re perfect for starting a collection or filling specific gaps.

Historical pieces bring a sense of the past. Older coins or jewelry might have stories linked to significant events or eras. This can make them fascinating to study and more valuable to other collectors. Balance both types to create a well-rounded collection.

Modern items can also be good investments, retaining value over time. Historical items can often appreciate in worth due to their rarity and significance. Ensure you have a range of both to maintain interest and value in your collection.

Legal Considerations

When collecting gold and silver, you need to be aware of various legal considerations. This includes customs regulations, taxes, and ensuring that your sources are ethical.

Customs and Import Restrictions

When buying gold or silver from other countries, you must know the customs regulations. Different countries have strict rules about importing precious metals. Some require special permits, while others limit the amount you can bring in. Not following these laws can result in fines or confiscation of your items.

Before purchasing, check the import laws of both your home country and the country you are buying from. This will save you from potential legal issues and ensure a smooth transaction.

Tax Implications

Owning gold and silver can have tax implications. In many places, you might have to pay taxes when you buy, sell, or even just hold these metals. For example, in the United States, physical gold and silver are considered collectibles, which means that profits from selling them can be taxed at a higher rate.

It’s smart to consult a tax professional to understand your responsibilities. They can help you navigate your local tax laws, making sure you remain compliant and avoid any unexpected bills.

Ethical Sourcing

Ethical sourcing is crucial when collecting gold and silver. Some mining operations have been linked to human rights abuses and environmental damage. It’s important to ensure that your metals come from reputable sources that respect workers’ rights and follow environmental guidelines.

Look for certifications like Fairtrade or conflict-free labels that indicate ethical practices. By doing this, you support responsible mining operations and contribute to a better world.

Frequently Asked Questions

Collecting gold and silver, especially coins, is a hobby that fascinates many people. This guide answers common questions about numismatics, the popularity of coin collecting, how to start, and how to evaluate and authenticate your collection.

What does numismatics refer to in the context of a hobby?

Numismatics is the study or collection of currency, including coins, tokens, paper money, and related objects. When you engage in numismatics as a hobby, you explore the history, design, and rarity of these items. It’s about appreciating the art and heritage of money.

Is the interest in coin collecting waning among hobbyists?

Interest in coin collecting remains strong. While market trends can fluctuate, there is a steady number of hobbyists passionate about coins. Coins carry historical significance and tangible value, which keep them attractive to collectors of all ages.

What are the advantages of engaging in coin and precious metal collecting?

Collecting coins and precious metals can be a rewarding hobby. It lets you learn about history, geography, and art. Additionally, it can be a wise investment. Well-maintained collections can retain or even increase in value over time, providing both educational and financial benefits.

How can one initiate a coin collection as a formative hobby?

Starting a coin collection begins with small, affordable purchases. Look for coins from your own country or interesting foreign coins. Join collector clubs, participate in forums, and attend coin shows. Learn about different coins and gradually build your collection based on your interests and budget.

What are the key factors to consider when authenticating collectible coins?

When authenticating coins, consider their weight, diameter, thickness, and engraving details. Check for mint marks and other identifying features. Condition, or “grade,” is also crucial. Working with certified coin dealers or using trusted grading services can help ensure authenticity and value.

How does the value assessment of gold and silver items factor into the collecting hobby?

Value assessment for gold and silver items involves understanding current market prices and the specific factors affecting individual items. These include rarity, historical significance, condition, and demand among collectors. Regularly check market trends and consult experts for accurate appraisals to track the value of your collection.

Buy coins at Mintbuilder

Buying coins can be a great way to expand your collection. Mintbuilder is a trusted platform where you can find various coins, including gold and silver.

Benefits of Buying Coins at Mintbuilder:

- Wide Selection: They offer a large variety of coins.

- Competitive Prices: You can find fair prices on your purchases.

- Quality: High-quality gold and silver coins are guaranteed.

When you become a VIP Customer, you unlock exclusive access to the best prices on precious metals. This membership can help you save money and get better deals. The VIP membership is even on sale now, so you can join at a discounted rate.

Getting Started:

- Sign Up: Create an account.

- Browse: Look through their extensive coin collection.

- Purchase: Buy the coins you like.

Buying coins from Mintbuilder can be an enjoyable and rewarding experience. You get to access high-quality coins and save money along the way.